EBA publishes guidelines on lending and monitoring

"Stronger regulation and supervision aimed at problems with underwriting practices and lenders' risk management would have been a more effective and surgical approach to constraining the housing bubble."

Ben Bernake, President, Federal Reserve Board, 2006-2014

background

On May 29, 2020, the European Banking Authority published its new Guidelines on Loan Origination and Monitoring and thus the binding interpretation of Article 74 of the Capital Requirements Directive of 2013.

The aim of the guidelines is to harmonize and strengthen the lending and monitoring standards of the supervised institutions in order to be able to better guarantee the stability and sustainability of the financial system in the future, even in more difficult market phases. In particular, the standards are intended to be specified to such an extent that a further increase in the volume of non-performing loans (NPLs) is prevented, and thus in the process of credit risk management they are well ahead of the guidelines for the treatment of NPLs published in 2018 ( Guidelines on management of non-performing and forborne exposures ). Among other things, they also replace the previously valid creditworthiness assessment requirements from 2015 ( EBA Guidelines on creditworthiness assessment ).

In addition, the guidelines also aim to align procurement and monitoring standards with European customer protection regulations.

Time horizon for implementation

As stated in the associated Explanatory Note , the requirements set out here are in principle - particularly in light of the current pandemic situation - only to be applied after a transition period in the form of a sliding phase-in, which was granted as follows:

- From June 30, 2021 application for newly awarded credit business

- From June 30, 2022 application for newly negotiated existing business

- From June 30, 2024 application for the entire existing business

However, the transition period granted must not obscure the fact that all essential elements of the guidelines must be implemented by the institutions subject to central supervision within a year

For banks subject to national supervision, implementation will only be binding after the guidelines have been implemented in the respective state law, for Germany, for example, with a MaRisk amendment expected in 2021.

challenges

In contrast to the MaRisk regulations for the German legal area, which are formulated in principle in a more open and therefore proportionally more interpretable manner, these are significantly more extensive and clearly formulated requirements where, despite all the conceptual proportionality, there is less room for interpretation.

A focus of the guidelines is naturally on the requirements for the structural and process organization, as regulated for German institutions in BTO 1 of MaRisk.

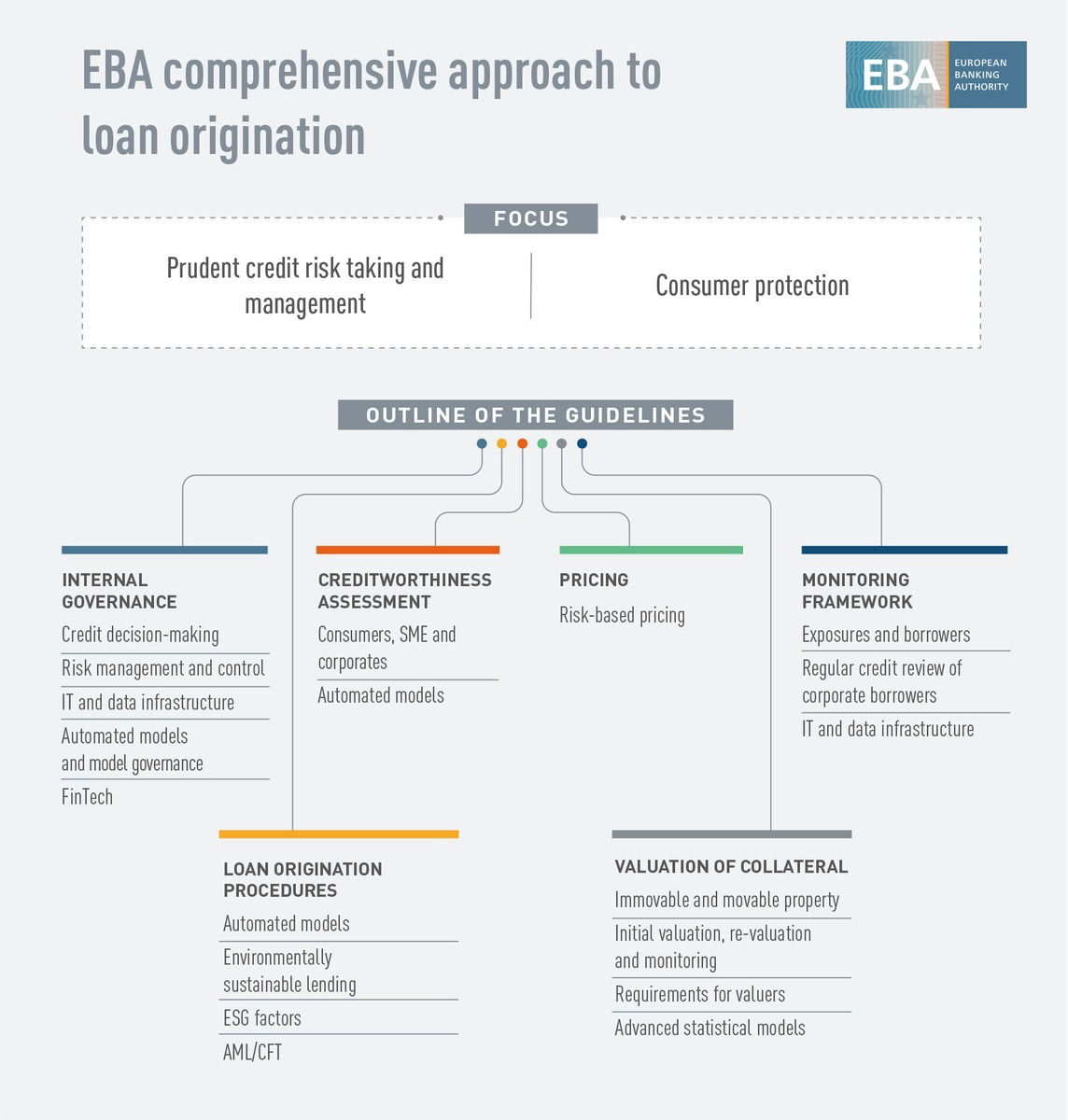

However, the guidelines here go beyond the original credit processes and can be divided into the six core areas shown in the following graphic, which cover the entire life cycle of the (non-performing) credit business, from the allocation of competences to credit decision models, credit processes and that Reporting through to IT and data infrastructure. In particular, this concerns the following topic blocks:

- Credit risk governance and risk culture

- Loan granting procedure

- Checking the borrower's creditworthiness (technically part of the loan granting process)

- Pricing

- Valuation of real estate and movable assets

- Surveillance system

The relatively new topic of environmentally sustainable lending is also considered here. In the future, environmental, social and governance (ESG) factors and risks will have to be embedded in risk appetite, risk policies, credit policies and processes.

Requirements relating to combating money laundering and countering terrorist financing have also been incorporated into the guidelines, in the form of a description of expanded requirements in the area of Know Your Customer (KYC).

Furthermore, the topics of pricing and collateral valuation in particular are regulated much more extensively than is the case in the corresponding sections of MaRisk.

However, since there is also a lot of focus on the topic of model development and use, it is surprising that - contrary to the wishes of the supervised institutes expressed during the consultation process - there is no reference to artificial intelligence and machine learning techniques, and even those The definition of “technology-enabled innovations for lending” considered in the guidelines is unclear on this issue. In principle, there are rather rough guidelines here, such as the reference to the fact that interpretable models may be preferable to those that require explanation.

The EBA itself refers to the Report on Big Data and Advanced Analytics , in which eight so-called “Elements of Trust” were defined. The guidelines should therefore be read in conjunction with this report, particularly in connection with the use of artificial intelligence techniques that are spreading in industry.

Overall, however, it can be assumed that most supervised institutions will face extensive requirements and the need for adjustments along the entire value chain. The associated material investment requirements and project effort should also take into account the short time horizon for implementation.

Recommendation

Against this background, we recommend that all institutions covered by the CRD immediately familiarize themselves with the published guidelines - if this has not already been done during the consultation process - and identify the necessary measures and plan their implementation.

A multi-stage approach is recommended:

- Comparison of the guidelines with the already valid MaRisk

- Determination of the gaps between MaRisk and guidelines

- Addition of current gaps in the implementation of relevant sections of MaRisk

- Description and prioritization of the required measures

- Planning and carrying out the implementation

What is important here is that successful implementation of the guidelines not only leads to better transparency, but - if implemented correctly - also to greater stability and sustainability in the loan portfolio and thus the entire institution.

Our support

As a management consultancy specializing in the area of credit risk management, we have extensive experience in implementing regulatory requirements for credit processes, credit decisions, credit risk management and credit reporting.

We provide support in the interpretation of regulatory requirements and the corresponding gap analyzes as well as in the planning and implementation of projects to implement the resulting requirements.

For further information about our range of services, you can reach us at any time at info.de@gutmark.eu .