Use of AI in loan origination/monitoring

EBA guidelines and AI

EBA 's guidelines for lending and monitoring (EBA/GL/2020/06), which will come into force shortly, the term “technology-supported innovations” addresses a complex of topics that is of broad interest in the market.

Use of AI in industry

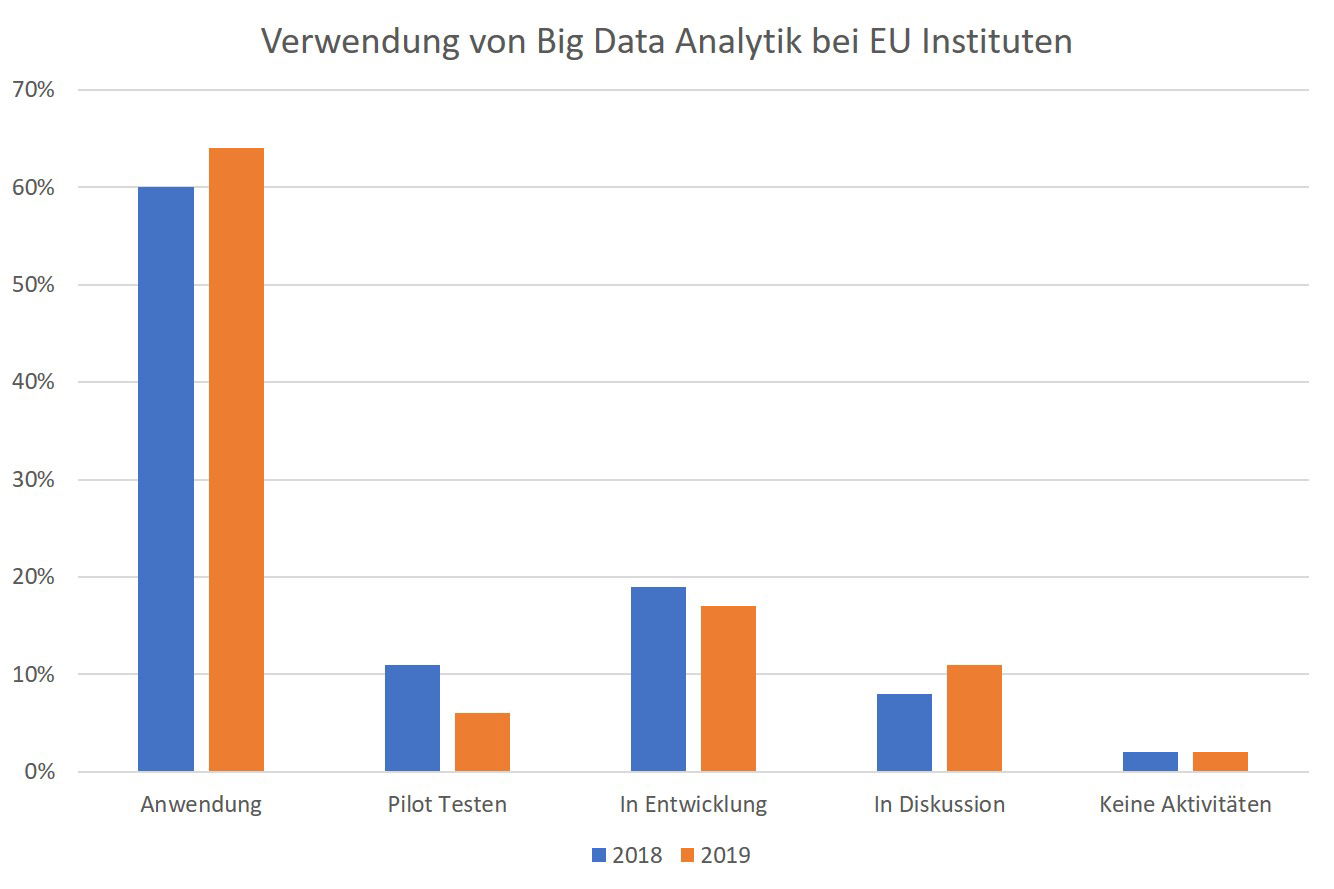

According to an evaluation as part of their EBA report on big data and advanced analytics (EBA/REP/2020/01), over 60% of the institutes surveyed in the EU are already using so-called big data analytics solutions. The productive use was in the area of risk management Although it is still under 35%, the trend is increasing. This current relatively low proportion of use in risk management can be explained, among other things, by the fact that the regulatory requirements for such use were not yet sufficiently clarified.

Requirements for the use of AI

However, with these guidelines, the EBA is now moving in the direction of necessary clarification of these requirements. Although the guidelines themselves only briefly address the concept of technology-enabled innovation in the section on strategies and procedures for credit risk, the associated feedback table EBA GL 2020 06 Appendix - Feedback Table issued by the EBA as part of the consultation process goes further GL on loan origination and monitoring explicitly addresses this topic under question 3. In particular, the aforementioned EBA report on big data and advanced analytics is referenced here.

“Big Data & Advanced Analytics” represents a suitable umbrella term, which particularly includes techniques for using methods in the field of artificial intelligence. In our technical article in the workbook New EBA Guidelines for Loan Granting/Monitoring by FCH Verlag, we discuss the requirements on this topic resulting from the EBA guidelines, as well as additional partial requirements from the ethics guidelines for trustworthy AI from the independent high-level expert group for artificial intelligence European Commission.

The trust elements of the EBA

In particular, we look at the eight so-called trust elements that formulate supervisory requirements for innovative technologies:

- ethics

- Explainability and interpretability

- Fairness & avoidance of bias

- Traceability and auditability

- data protection

- Data quality

- Security

- Customer protection

These trust elements result in requirements for the EBA's four-pillar model in the area of Big Data & Advanced Analytics with its elements data management, technological infrastructure, organization & governance and analytics & methodology.

Requirements in detail

For a more detailed look at these requirements, please contact us or read our technical article in the workbook .

About Us

Gutmark, Radtke & Company (GRCO) is a management consultancy specializing in the financial services sector. We have been supporting our clients throughout Europe in implementing complex projects since 2001. An important part of our work is model development, particularly in the area of credit risk management.

For further information about our experience, our company or how we can support you, please feel free to contact Dr. Benny Gutmark or Hans Radtke .